Choosing the right forklift battery is critically important

Forklift batteries are no longer just a “commodity” purchase tucked away in a maintenance budget. In the modern warehouse, Lithium-ion vs. Lead-Acid batteries are a high-stakes operational decision. Choosing the wrong power system creates a domino effect of inefficiency: trucks dropping off the line mid-shift, drivers congested at charging stations, and supervisors managing battery water levels instead of throughput.

When the power system matches the job, it fades into the background and productivity goes up. Our motive power experts at Exponential Power put this guide together to help you pick the right battery for your operation, and to decide if moving from lead-acid to lithium-ion makes sense.

Start With Your Operating Profile

Most electric forklifts were originally engineered around the weight and discharge characteristics of lead-acid batteries. For many single-shift operations, this classic setup remains a strong fit. The rhythm is simple: work for eight hours, charge for eight hours, and let the battery cool for eight hours.

As warehouses move toward multi-shift and 24/7 schedules, that rhythm can become a bottleneck. Before you compare price tags, define your utilization: shifts per day, break patterns, whether you can opportunity charge, and how much downtime you can tolerate.

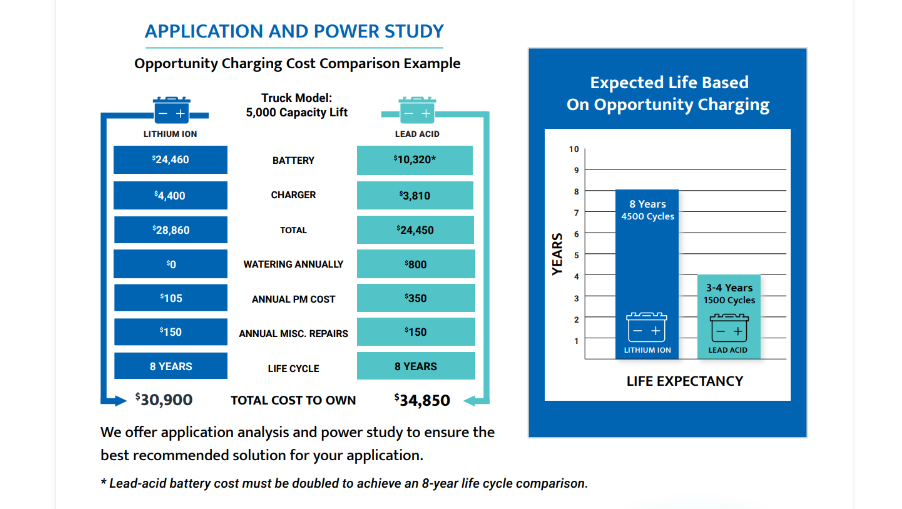

Cost Comparison: Opportunity Charging Example

The chart below shows a simplified cost comparison for a 5,000 lb capacity lift truck running opportunity charging. The key point is how quickly “cheap up front” can turn into “expensive to own” once you account for labor, maintenance, and replacement cycles.

Opportunity charging cost comparison example (5,000 lb capacity lift truck).

In this example, lithium-ion (battery + charger) is $28,860 versus $24,450 for lead-acid. The difference is lead-acid needs more ongoing care and typically does not last as long under opportunity charging.

Lithium-ion shows $0 for watering, plus $105 in annual PM and $150 in misc. repairs. Lead-acid shows $800 a year for watering, $350 in annual PM, and $150 in misc. repairs. On life expectancy, lithium-ion is shown at 8 years (about 4,500 cycles), while lead-acid is 3 to 4 years (about 1,500 cycles), so an 8-year comparison assumes a lead-acid replacement, which is why the battery cost is doubled.

Bottom line: total cost to own is $30,900 for lithium-ion vs. $34,850 for lead-acid, a $3,950 advantage for lithium-ion here, plus fewer changeouts and less downtime.

When Lithium Pays Off

- Multi-shift fleets where uptime matters.

- Opportunity charging operations that rely on quick top-offs during breaks.

- Sites that want to reduce battery room labor, safety burden, or floor space.

- Fleets that want consistent power and fewer mid-shift slowdowns.

- Operations that value battery data, diagnostics, and charge control.

When Lead-Acid is Still the Smarter Choice

Despite the trend toward lithium-ion, lead-acid remains the right choice in specific scenarios:

- One-shift fleets with plenty of idle time, where payback is hard to justify.

- Battery room and maintenance processes already built, staffed, and running well.

- Upfront budget constraints paired with a light, forgiving duty cycle.

The Automation Factor: Why AGVs Demand Lithium

F

The move toward automated guided vehicles (AGVs) and autonomous forklifts changes the requirements. Automation removes the human variable, and it also removes the workarounds that keep lead-acid running in demanding applications.

AGV’s typically require:

- Predictable power: lithium-ion’s flatter discharge curve helps the vehicle perform consistently, even as state of charge drops.

- Fast sips of power: many AGVs dock for 5 to 10 minutes between tasks, and lithium-ion handles frequent micro-charging far better than lead-acid.

- Data integration: most lithium-ion systems include a battery management system (BMS) that communicates with the charger and the vehicle, which lets the fleet manage charging windows around real workflow.

Making the Strategic Move

At Exponential Power, we rarely recommend a one-size-fits-all conversion. Many of the most efficient sites run a hybrid fleet: lithium-ion for high-intensity lanes and automation, lead-acid for lower-use utility trucks where the duty cycle is forgiving.

If you are considering a change, we can run an application analysis and power study to match the battery to your equipment, your shifts, and your charging reality. The goal is simple: maximize ROI, minimize downtime, and keep your fleet moving.